DDP in the Garment Industry: A Simple Guide for Buyers and Sellers

In the garment industry, shipping terms can sometimes feel confusing. Among them, DDP – Delivered Duty Paid – is one of the most important. This term tells you who takes care of what during the shipment of finished garments, fabrics, trims, or accessories. Many buyers like DDP because it offers a simple and stress free experience. On the other hand, sellers must take on a wide range of responsibilities to make it work. This article explains DDP in a clear and friendly way so you can understand how it helps, when to use it, and what risks it carries.

What Is DDP – (Delivered Duty Paid) ?

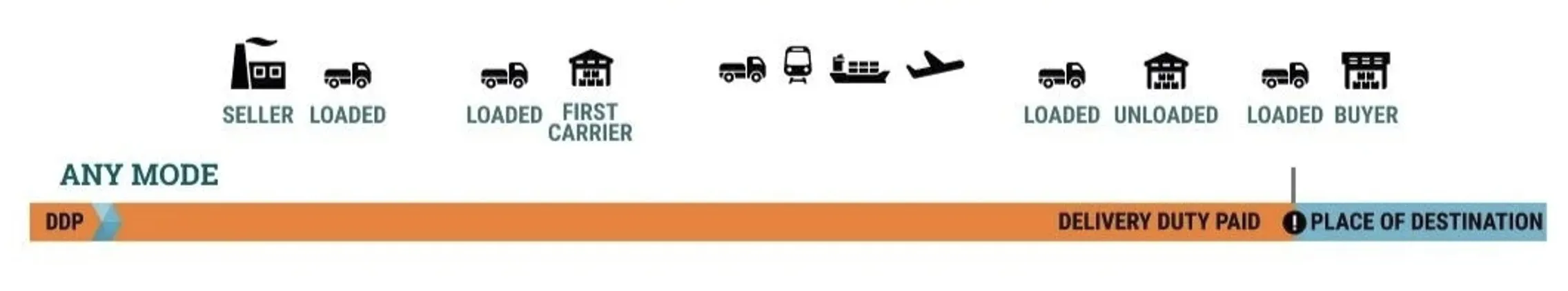

DDP stands for Delivered Duty Paid, a shipping term where the seller takes full responsibility for bringing the goods all the way to the buyer’s final address. The seller handles everything from export steps in the origin country to import steps in the destination country. In simple words: The seller does all the work. The buyer just waits for the goods.

=> Related Article: OEM/FOB in the Garment Industry: What It Really Means

How DDP Works Step by Step

To see the true value of DDD, it helps to look at the process step by step. Each stage shows how much effort the seller puts in to ensure the goods reach the buyer smoothly. These steps also highlight where time, cost, and risk can increase if not managed well. Below is a clear flow of how garments move Under DDP, the seller manages every step:

- Production: The seller produces the goods (T-shirts, uniforms, jeans, etc.).

- Packaging and preparing shipments: The seller packs garments safely, labels each carton, and prepares all shipping documents.

- Export clearance: The seller completes paperwork in the origin country, such as commercial invoices, packing lists, and export declarations.

- International shipping: Whether by air or sea, the seller books the freight and pays the transport cost.

- Insurance (if purchased): While not required, many sellers choose to insure the goods to reduce risk.

- Arrival at the destination country: The seller’s agents handle unloading and move the cargo toward customs.

- Import customs clearance: The seller prepares import documents, answers customs questions, and ensures the cargo enters the country legally.

- Paying duties and taxes: This is a major part of DDP. The seller pays all import duties, VAT/GST, and any related fees.

- Final delivery to the buyer’s door: After customs clearance, the seller ships the goods to the buyer’s warehouse, office, or home.

At the end of all these steps, the buyer simply signs for the goods.

=> Related Article: 4 Main Production Models in the Garment Industry: CMT, OEM/FOB, ODM, and OBM

Responsibilities Under DDP: Seller & Buyer

Seller’s Responsibilities

Under DDP, the seller must:

- Handle export procedures

- Book and pay for shipping

- Handle customs clearance in both countries

- Pay all import duties, taxes, and fees

- Deliver the goods to the buyer’s final address

- Cover risks and extra costs until delivery is complete

This makes DDP the Incoterm with the highest level of workload for the seller.

Buyer’s Responsibilities

The buyer only needs to:

- Pay for the goods

- Receive the shipment

No extra cost. No customs. No paperwork.

Costs and Risks Under DDP

Costs and risks are major concerns in international trade. Under DDP, these responsibilities stack up heavily on the seller. Knowing what the seller must pay helps explain why DDP prices are often higher than other shipping terms. It also highlights the importance of careful planning on the seller’s side. DDP places all costs and all risks on the seller until the goods arrive safely at the buyer’s address. This includes:

- Freight charges

- Insurance

- Export charges

- Import duties and taxes

- Trucking from destination port to the buyer’s door

- Any delays or unexpected customs issues

=> Related Article: What Is CMPT (Cut, Make, Pack & Trim) in the Garment Industry?

Because of this, the seller must understand the rules and tax rates of the buyer’s country. Problems like misdeclared goods, missing documents, or slow customs processing can create extra costs that the seller must absorb.

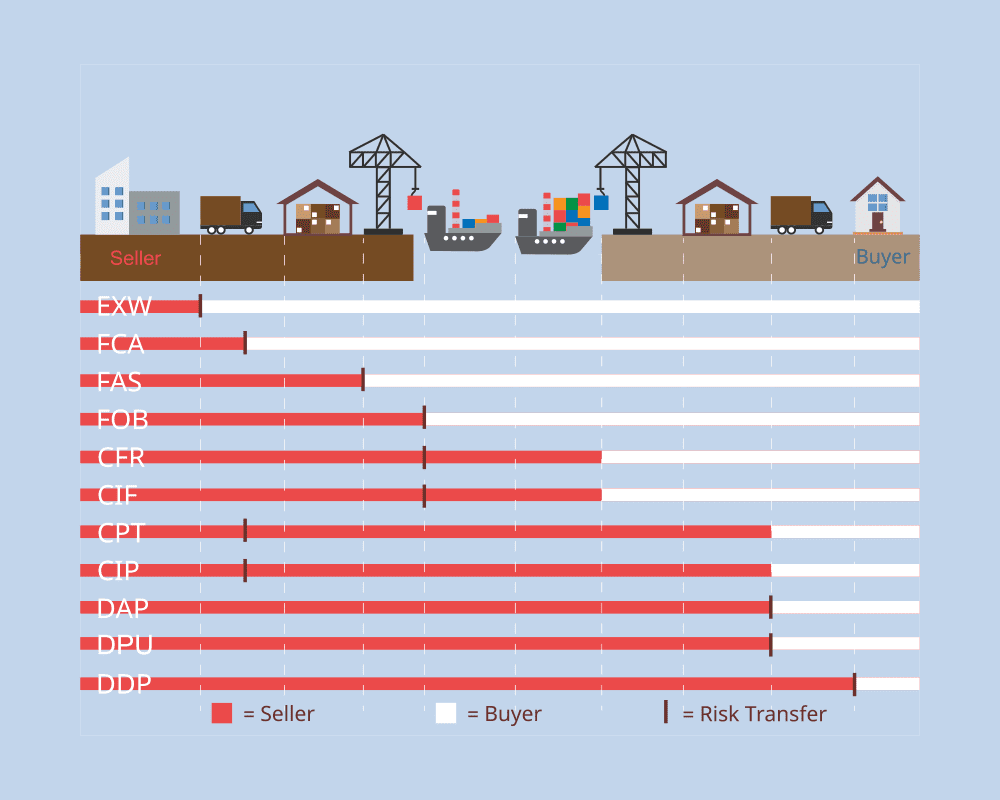

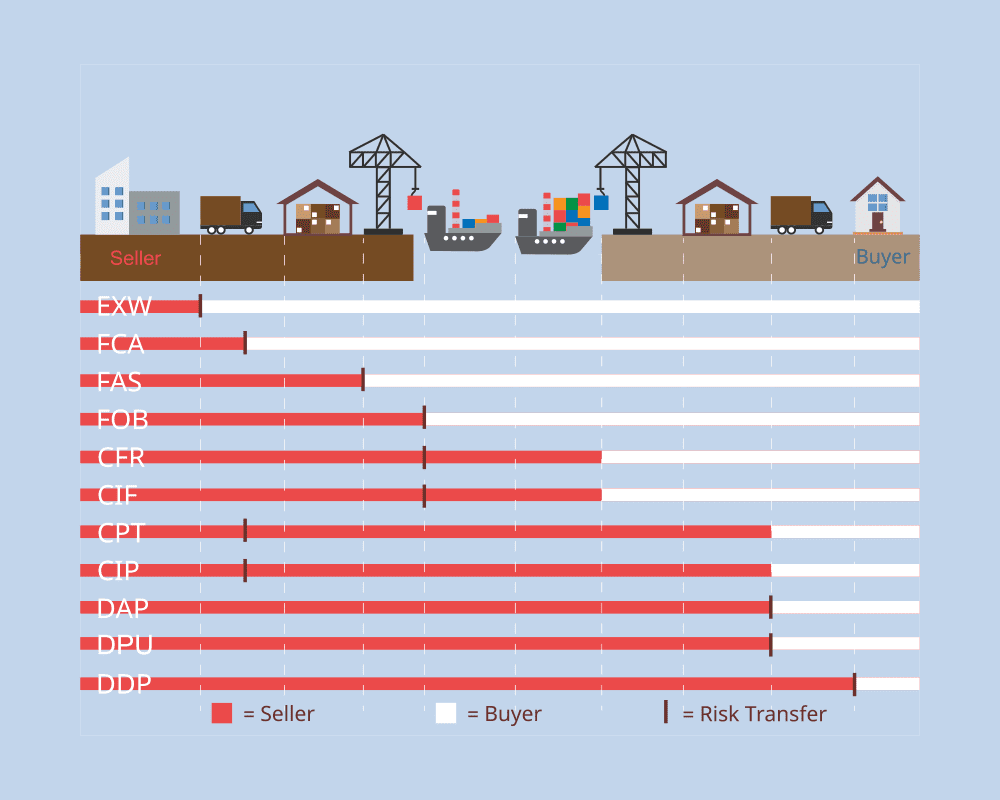

DDP vs FOB vs CIF – Comparison Table

This table gives a clear, side-by-side view of DDP, FOB, and CIF, three of the most common used in international trade especially in the garment industry. By reading this comparison, you can quickly understand how responsibilities change under each option, from factory gate to final delivery. This helps buyers and sellers choose the right shipping term based on cost control, experience level, and risk tolerance, avoiding confusion and costly mistakes before signing a contract.

=> Related Article: 6 Types Of Tag Printing Techniques For Your Apparel Brands

| Factor | DDP (Delivered Duty Paid) | FOB (Free On Board) | CIF (Cost, Insurance & Freight) |

|---|---|---|---|

| Who Handles Most Work? | Seller handles everything until delivery to buyer’s door | Seller handles origin steps; buyer handles all after loading | Seller handles freight + insurance to destination port; buyer handles local import steps |

| Who Pays for Shipping? | Seller | Buyer | Seller |

| Who Pays for Insurance? | Seller (optional) | Buyer | Seller |

| Who Pays Import Duties & Taxes? | Seller | Buyer | Buyer |

| Risk Transfer Point | At buyer’s final address | When goods are loaded onto the vessel at origin port | When goods are loaded onto the vessel at origin port |

| Buyer’s Workload | Very low | Medium to high | Medium |

| Seller’s Workload | Very high | Low | Medium |

| Best For | Buyers who want simple, no-stress delivery | Experienced buyers who manage their own shipping | Buyers wanting seller to cover sea freight but not customs |

| Cost Level | Highest (seller pays everything) | Lowest (buyer pays most logistics costs) | Medium (seller pays freight + insurance) |

| Customs Clearance (Destination) | Seller handles all | Buyer handles all | Buyer handles all |

| Local Delivery (Final Mile) | Seller | Buyer | Buyer |

| Typical Use in Garment Industry | E-commerce brands, small buyers, new importers | Big retailers, factories with logistics teams | Mid-size brands wanting shared responsibility |

Final Word / Conclusion

DDP is one of the easiest and most comfortable shipping terms for buyers in the garment industry. It gives them full peace of mind because the seller handles everything from the factory gate to the buyer’s doorstep. But for sellers, DDP requires careful planning, accurate cost calculation, and strong logistics knowledge to avoid unexpected expenses.

FAQs About DDP in the Garment Industry

In Short, What does DDP mean in simple terms?

DDP stands for Delivered Duty Paid. It means the seller takes full responsibility for the shipment from start to finish. The seller packs the garments, arranges transportation, clears customs, pays all import taxes and duties, and delivers the goods directly to the buyer’s address. The buyer does not need to deal with shipping, customs, or paperwork. They simply wait for the goods to arrive and receive them.

In Short, Why do many buyers prefer DDP?

Many buyers choose DDP because it removes stress and uncertainty. They do not need to understand customs rules, import taxes, or shipping documents in their country. There are no surprise fees at delivery, because everything is already included in the price. For brands, retailers, or first-time importers, DDP makes buying garments much easier and more predictable.

What costs does the seller pay under DDP?

The seller pays for export fees, freight, insurance (if used), customs clearance, import duties, VAT/GST, and final delivery. Every cost from start to finish is the seller’s responsibility.

Does DDP include customs clearance at the destination?

Yes. This is a key point of DDP. The seller must handle customs clearance in the buyer’s country, including submitting documents and paying all required import duties and taxes. The buyer does not need to contact customs or hire a customs broker. This is why DDP is often described as a “door-to-door, worry-free” shipping term.